What Is Net Growth and Why It Matters

Net growth refers to the overall increase in a company’s size or value after accounting for losses, attrition, and other offsetting factors. Unlike raw gains, this figure paints a clearer picture of genuine expansion. For investors and decision-makers, understanding net growth helps assess whether a firm is truly scaling or merely replacing lost ground. In many cases, a strong net growth rate signals operational efficiency, robust demand, and the potential for sustained earnings improvements.

Key Metrics for Measuring Company Expansion

Tracking multiple indicators delivers a holistic view of a business’s trajectory. Below are four essential metrics.

| Metric | What It Shows | Why It’s Valuable |

|---|---|---|

| Revenue Growth Rate | Year-over-year or quarter-over-quarter sales increase | Gauges top-line momentum; highlights market demand |

| Customer Acquisition Growth | Net new customers relative to prior period | Reflects marketing ROI and brand appeal |

| Employee Headcount Growth | Change in staff numbers | Indicates capacity expansion and investment needs |

| Market Share Expansion | Percentage point gains versus competitors | Measures competitive positioning |

Revenue Growth Rate

This figure shows how quickly sales are rising. Historical data suggests that firms sustaining annual revenue gains above 15% often outperform peers during economic upcycles.

Customer Acquisition Growth

Tracking net additions—including churn—reveals whether your marketing and product efforts resonate. Higher acquisition growth can presage future profit gains, but beware of excessive cost per user.

Employee Headcount Growth

Staff increases often accompany new market entries or product launches. A balanced hiring plan ensures operations keep pace without bloating overhead.

Market Share Expansion

Gaining share in a mature market signals competitive strength. Even small point gains can translate into sizable revenue if the overall market is large.

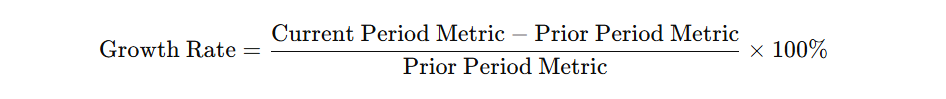

How to Calculate Net Growth Metrics

Quantifying expansion requires standardized formulas and consistent data inputs.

- Period-over-Period Growth

Use quarterly or annual figures for sales, customers, or headcount.

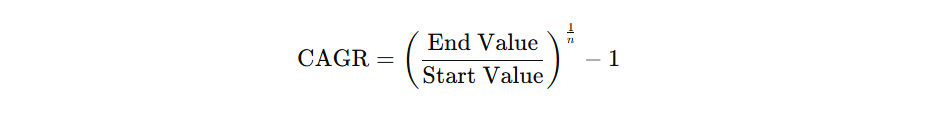

- Compounded Annual Growth Rate (CAGR)

Useful for smoothing out volatility over multi-year horizons.

- Cohort Analysis for Customer Growth

Segment customers by acquisition date, then track retention and revenue per cohort to isolate genuine expansion from one-off spikes.

Real-World Net Growth Examples

- Tech Unicorn Surge: A cloud-software firm scaled revenue at a 40% CAGR over three years by leveraging freemium onboarding and upsells.

- Retail Chain Optimization: A specialty retailer grew same-store sales by 8% annually while closing underperforming outlets, resulting in net-positive store count.

- Healthcare Startup: By focusing on referrals, a telemedicine platform doubled its paying-user base in 12 months with minimal ad spend.

Tools and Software for Net Growth Analysis

- Tableau or Power BI: Interactive dashboards for visualizing multiple growth indicators side by side.

- Salesforce Analytics: Tracks customer life-cycle metrics and cohort retention curves.

- Workday Adaptive Planning: Integrates headcount forecasting with financial projections.

- MarketSharePro: Specialized for benchmarking competitive share data across industries.

- MetaTrader 5 app download: Import your net‐growth figures into MT5 for on‑the‑fly charting, custom indicators, and mobile alerts—ideal for executives who need expansion metrics at their fingertips.

Factors Influencing Net Growth

- Macroeconomic Conditions: GDP trends, interest-rate cycles, and consumer confidence can accelerate or stall expansion.

- Competitive Dynamics: New entrants or pricing wars may compress margins and slow customer gains.

- Operational Efficiency: Supply-chain bottlenecks or talent shortages limit the pace at which a firm can scale.

- Regulatory Environment: Licensing requirements, tariffs, or compliance mandates can impose headwinds.

Common Pitfalls in Net Growth Analysis

- Ignoring Churn: Focusing solely on new acquisitions without accounting for attrition overstates real growth.

- Overlooking Seasonality: Comparing a peak quarter to a trough period can produce misleading spikes.

- Combining Incompatible Data: Mixing different definitions of “active user” or “net revenue” skews results.

- Neglecting Quality of Growth: Rapid expansion funded by unsustainable discounts or high customer-acquisition costs can erode profitability.

How to Translate Metrics into Profitable Strategies

Aligning Growth Goals with Operational Capacity

Ensure your infrastructure, staffing, and supply chains can support desired scale. Overextension leads to service lapses and reputational damage.

Pricing and Monetization Adjustments

Use elasticity studies to fine-tune pricing. In some sectors, small rate bumps can boost net growth without materially impacting retention.

Resource and Budget Allocation

Prioritize high-ROI channels—whether marketing, R&D, or geographic expansion—to allocate capital efficiently and avoid diluting core strengths.

Conclusion: Leveraging Net Growth for Strategic Advantage

Accurate analysis of expansion metrics provides a roadmap for resource deployment, competitive positioning, and long-term value creation. By combining rigorous calculation methods, real-world benchmarks, and disciplined execution, investors and executives can harness net growth insights to make informed decisions, mitigate risk, and unlock sustainable profitability.